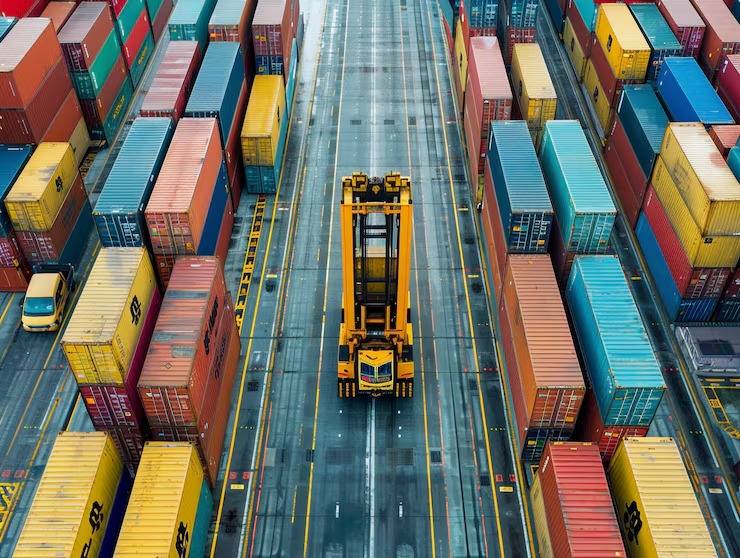

Customs procedures and import taxes are often underestimated by businesses entering international trade. Many buyers assume that once goods are produced and shipped, the rest of the process is straightforward. In reality, customs regulations are constantly evolving, and even small changes can have serious financial and legal consequences if they are not handled correctly.

Import taxes, duties, and fees do not remain fixed. Rates can change due to government policy adjustments, trade agreements, or new enforcement measures. A product that was cleared smoothly last year may suddenly be subject to higher duties, additional taxes, or stricter inspection requirements. Factories and inexperienced importers are often unaware of these changes until a shipment is already in transit or held at the port.

Another common issue involves product classification. Customs authorities rely heavily on accurate HS codes to determine applicable duties and regulations. When products are misclassified—whether unintentionally or due to outdated information—shipments can be delayed, re-assessed, or penalized. Factories may provide incorrect or incomplete classification details, not out of bad intent, but simply because customs compliance is not their area of expertise.

Regulatory requirements also change over time. Certain products that were previously unrestricted may suddenly require certificates, testing reports, or conformity documents. Others may become partially restricted or even banned altogether due to safety, environmental, or consumer protection regulations. Importers who are unaware of these changes often find themselves facing unexpected documentation requests, fines, or shipment rejections at the destination port.

Many people believe that obtaining certificates or meeting customs requirements is a simple administrative task. In practice, these processes involve detailed technical standards, coordination with accredited bodies, and precise documentation. Mistakes in certificates, missing approvals, or incorrect declarations can result in long delays and additional costs. What seems easy on the surface often requires professional knowledge and continuous monitoring of regulatory updates.

Factories typically focus on production and delivery schedules. They are not responsible for tracking international regulatory changes or advising clients on customs risks in foreign markets. Likewise, individual importers may rely on outdated information or assumptions based on past shipments, only to discover that the rules have changed.

This is where working with a professional trading company becomes essential. A trading company stays informed about regulatory updates, tax changes, and compliance requirements across different markets. It ensures that products are correctly classified, documentation is accurate, and shipments meet current customs regulations before they are dispatched.

At Alanovas, we closely monitor customs procedures and regulatory developments to protect our clients from unexpected issues. Over the years, we have helped businesses avoid costly delays, incorrect tax assessments, and compliance-related problems by handling these matters professionally from the start. Our experience allows clients to focus on their business while we manage the complexities of international trade on their behalf.

In a global trade environment where rules are constantly changing, professional guidance is not optional—it is essential. Partnering with an experienced trading company helps ensure that shipments move smoothly, costs remain predictable, and compliance risks are kept under control.